Debt Payoff Tracker Printable: Manage Your Finances Easily sets the stage for this captivating narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

In this article, we will explore what a debt payoff tracker printable is, its benefits, and how to use it effectively. We’ll also provide insights into creating and designing your own tracker, key components to include, and strategies for tracking progress and staying motivated.

Additionally, we’ll share valuable resources and success stories to inspire you on your debt payoff journey. So, let’s dive in and discover how a debt payoff tracker printable can transform your financial management.

Introduction to Debt Payoff Tracker Printable

![]()

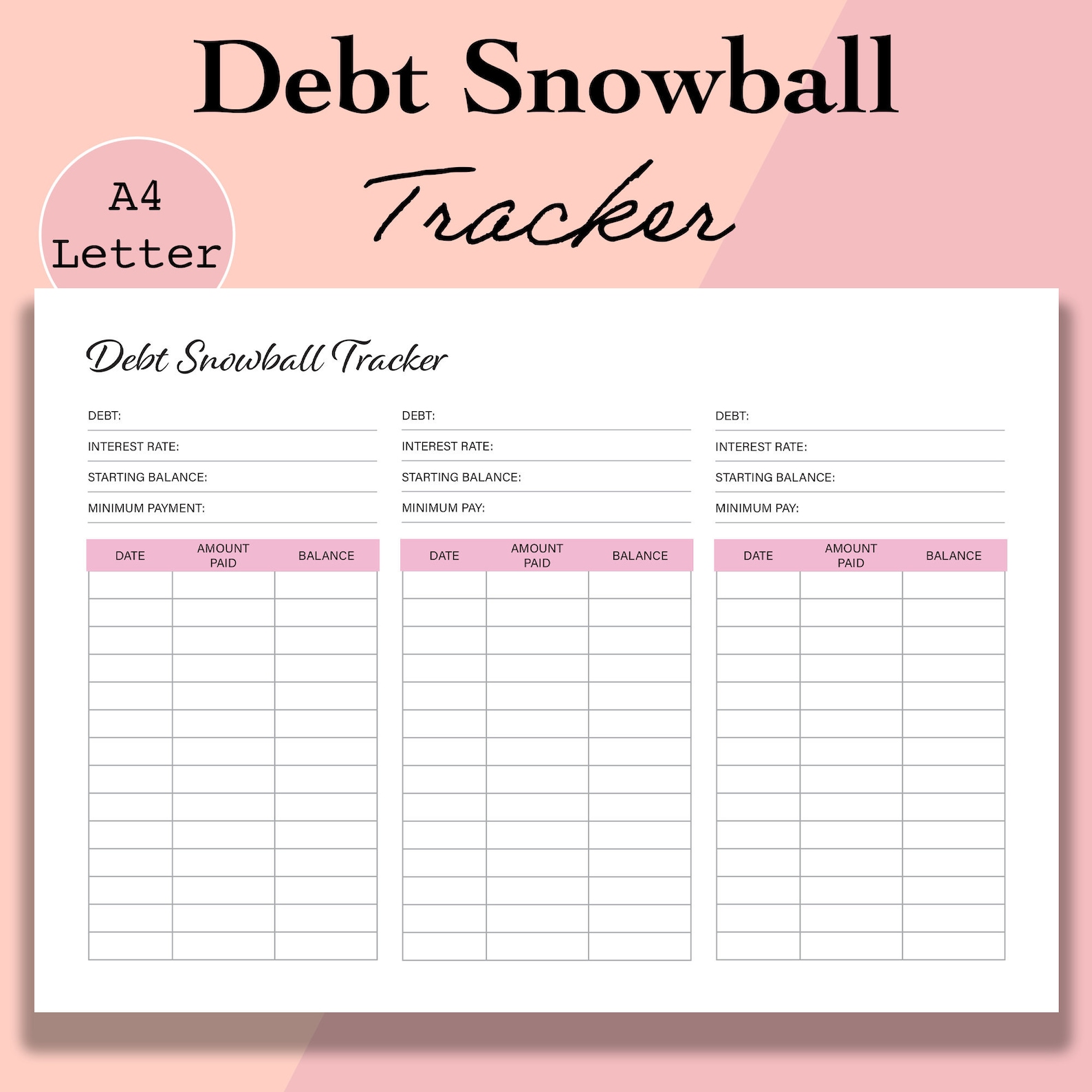

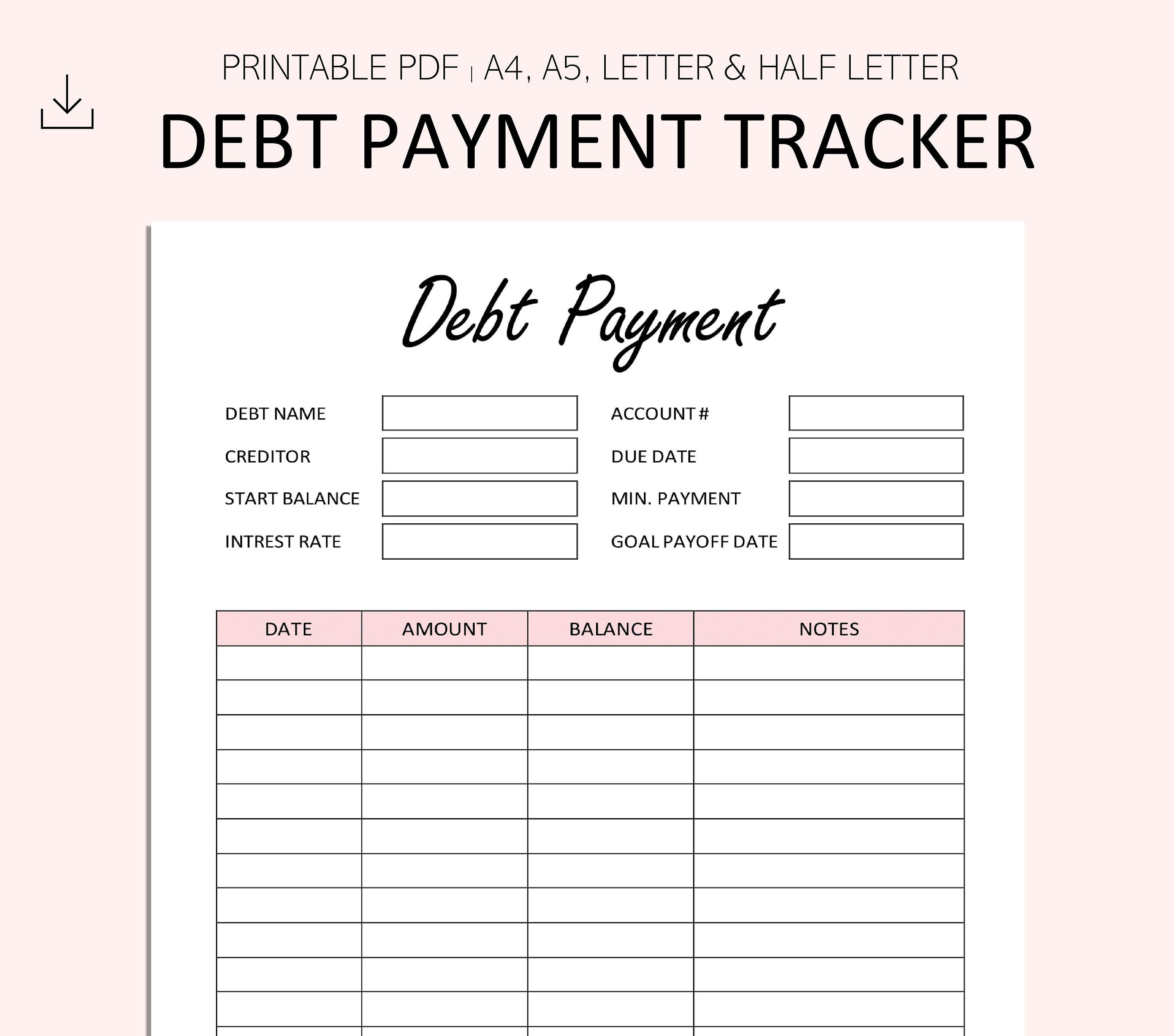

A debt payoff tracker printable is a tool that helps individuals keep track of their debts and monitor their progress towards paying them off. It is a printable document that can be filled out manually or digitally to record and track important information related to debts.Using

a debt payoff tracker printable offers several benefits. Firstly, it provides a visual representation of the debts, allowing individuals to see the overall picture of their financial obligations. This can help in prioritizing which debts to pay off first and creating a clear plan of action.Secondly,

a debt payoff tracker printable helps in keeping individuals accountable and motivated. By regularly updating the tracker with new payments and progress, individuals can see how far they have come and stay motivated to continue their debt repayment journey.There are various types of debt payoff tracker printables available.

Some are designed specifically for tracking credit card debts, while others cater to multiple types of debts such as student loans, mortgages, or personal loans. These printables may include sections to input details such as the creditor’s name, outstanding balance, interest rate, minimum payment, and progress towards paying off the debt.To

effectively use a debt payoff tracker printable, it’s important to follow a few tips. Firstly, gather all the necessary information about your debts, including the current balances, interest rates, and minimum payments. Input this information accurately into the tracker to ensure its effectiveness.Next,

set realistic goals for paying off your debts. Break down the total amount into smaller monthly or weekly targets and track your progress towards these goals in the printable. Celebrate each milestone achieved to stay motivated.Regularly update the tracker with new payments and changes in balances.

If you’re looking for printable resources to celebrate Black History Month, you can find a variety of options on the black history month printable website. From worksheets and coloring pages to educational games and crafts, there are plenty of materials available to engage and educate students of all ages.

Whether you’re a teacher looking for classroom resources or a parent wanting to supplement your child’s learning at home, this website has everything you need to make Black History Month a meaningful and enjoyable experience.

This will provide an accurate representation of your progress and help you identify any discrepancies or errors.Lastly, review your debt payoff tracker regularly and make adjustments as needed. As your financial situation changes, you may need to update your goals or strategies for paying off the debts.

By regularly reviewing and adjusting your tracker, you can stay on top of your debt repayment journey.

Examples of Different Types of Debt Payoff Tracker Printables

- A credit card debt payoff tracker printable with sections for recording the credit card issuer, outstanding balance, interest rate, minimum payment, and progress towards paying off the debt.

- A student loan debt payoff tracker printable with sections for recording the loan servicer, outstanding balance, interest rate, minimum payment, and progress towards paying off the debt.

- A general debt payoff tracker printable that can be customized to track multiple types of debts, including personal loans, mortgages, and car loans.

Tips on How to Effectively Use a Debt Payoff Tracker Printable

- Gather all the necessary information about your debts, including balances, interest rates, and minimum payments.

- Set realistic and achievable goals for paying off your debts.

- Regularly update the tracker with new payments and changes in balances.

- Review and adjust the tracker regularly to reflect changes in your financial situation.

Creating a Debt Payoff Tracker Printable

Creating a debt payoff tracker printable can be a helpful tool in managing and tracking your debt repayment progress. Here are the steps involved in creating a debt payoff tracker printable:

1. Determine your debt information

Start by gathering all the necessary information about your debts. This includes the name of the creditor, the outstanding balance, the interest rate, and the minimum monthly payment.

2. Choose a template

There are various templates available online that you can use as a starting point for your debt payoff tracker printable. Look for templates that are easy to understand and include all the necessary fields for tracking your debt.

3. Customize the template

Once you have chosen a template, you can customize it to fit your specific needs. Add or remove fields as necessary and make any design changes that you prefer.

4. Include important details

Make sure to include all the important details about your debts in the tracker. This includes the creditor’s name, outstanding balance, minimum monthly payment, interest rate, and due date.

5. Add payment columns

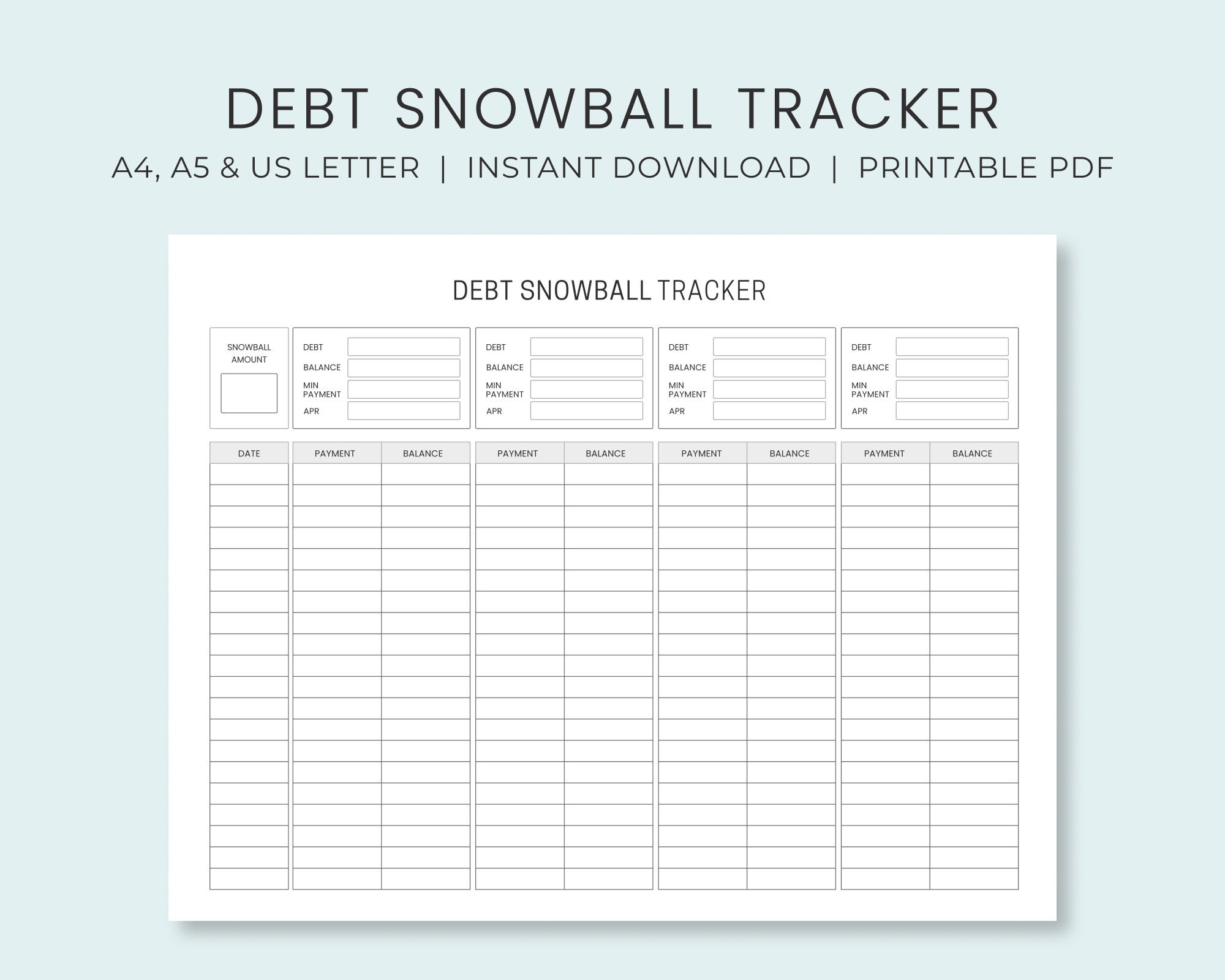

Create columns to track your payments. Include fields for the date of the payment, the amount paid, and the remaining balance.

6. Calculate totals

Include formulas or calculations to automatically calculate the total amount of debt, total amount paid, and the remaining balance. This will help you easily track your progress and see how much more you need to pay off.

7. Choose a format

Decide on the format of your debt payoff tracker printable. You can choose to create a simple table format or a more visually appealing design. Consider using different colors or fonts to make it easier to read and understand.

Different Design Options for a Debt Payoff Tracker Printable

When it comes to designing your debt payoff tracker printable, you have several options to choose from. Here are some design ideas:

1. Minimalist design

Keep the design simple and clean with a minimalist approach. Use a neutral color palette and simple fonts to create a sleek and modern look.

2. Motivational design

Incorporate motivational quotes or images into your tracker to keep you motivated throughout your debt repayment journey. Choose designs that inspire and encourage you to stay on track.

3. Visual charts

Consider using visual charts or graphs to visually represent your debt payoff progress. This can make it easier to understand and track your progress at a glance.

4. Color-coded system

Use a color-coded system to differentiate between different types of debts or to highlight important information. This can help you quickly identify and prioritize your debts.

5. Custom illustrations

If you have a creative flair, consider adding custom illustrations or icons to your tracker. This can add a personal touch and make the tracker more visually appealing.

Tips for Choosing the Layout and Format of a Debt Payoff Tracker Printable

When choosing the layout and format of your debt payoff tracker printable, consider the following tips:

1. Keep it simple

Avoid cluttering the tracker with too much information or unnecessary design elements. Keep the layout clean and easy to read.

2. Prioritize important information

Make sure to prioritize the most important information, such as the outstanding balance and minimum monthly payment. This information should be easy to find and understand.

3. Use clear headings

Use clear and descriptive headings for each section of the tracker. This will make it easier to navigate and understand the information.

4. Consider portability

If you plan to carry your tracker with you, consider creating a printable that can be easily folded or resized to fit into a wallet or planner.

5. Test readability

Before finalizing your design, make sure to test the readability of the tracker. Print a sample and check if the font size and colors are easy to read.Remember, the most important aspect of a debt payoff tracker printable is its functionality.

Choose a design and format that works best for you and helps you stay organized and motivated on your debt repayment journey.

Creating eye-catching bulletin boards is easy with the help of printable letters. Instead of spending hours cutting out individual letters, you can simply print them out from the comfort of your own home. The bulletin board letters printable website offers a wide range of letter templates in various fonts, sizes, and styles.

Whether you’re decorating a classroom, office, or community space, these printable letters will add a personalized touch to your bulletin board displays. Get creative and showcase important messages, quotes, or themes with ease using these convenient printable resources.

Key Components of a Debt Payoff Tracker Printable

![]()

Debt payoff tracker printables are helpful tools for individuals who want to stay organized and motivated while paying off their debts. These trackers allow you to keep track of your progress and visualize your journey towards becoming debt-free. Here are some key components that should be included in a debt payoff tracker printable:

1. Debt List

- Include a section where you can list all of your debts. This should include the creditor’s name, the amount owed, the interest rate, and the minimum monthly payment.

- Having a comprehensive list of your debts will help you prioritize which debts to pay off first and keep track of your overall debt load.

2. Payment Plan

- Create a section where you can Artikel your payment plan. This should include the amount you plan to pay towards each debt every month.

- Your payment plan will help you stay on track and ensure that you are making progress towards paying off your debts.

3. Progress Tracker

- Include a visual representation of your progress, such as a debt payoff thermometer or a progress bar. This will help you see how far you’ve come and motivate you to keep going.

- Update your progress tracker regularly to visually see your debt decreasing over time.

4. Monthly Budget

- Include a section where you can track your monthly income and expenses. This will help you identify areas where you can cut back and allocate more money towards debt repayment.

- A monthly budget will allow you to see how much extra money you have available to put towards your debts each month.

5. Debt Snowball or Debt Avalanche Method

- If you are using the debt snowball or debt avalanche method to pay off your debts, include a section where you can track your progress using these methods.

- The debt snowball method involves paying off the smallest debt first, while the debt avalanche method focuses on paying off the debt with the highest interest rate first.

- Tracking your progress using these methods will help you stay motivated and see the impact of your debt repayment strategy.

6. Notes and Reflection

- Include a space where you can jot down any notes or reflections about your debt repayment journey.

- Writing down your thoughts and feelings can provide a sense of accountability and help you stay motivated.

Remember that the layout and format of your debt payoff tracker printable can vary based on your personal preferences. You can find pre-designed templates online or create your own using a spreadsheet or word processing software.

Tracking and Updating Debt Payments

![]()

Tracking and updating debt payments is an essential part of using a debt payoff tracker printable. By regularly recording your payments and progress, you can stay organized and motivated on your journey towards becoming debt-free.

Methods for Recording Payments and Progress

There are various methods you can use to record your debt payments and track your progress:

- Manual Entry:One method is to manually record your payments on the printable tracker. This can be done by writing down the date, the amount paid, and the remaining balance for each debt. This allows you to have a physical record of your payments and see the reduction in your debt over time.

- Electronic Spreadsheet:Another option is to use an electronic spreadsheet, such as Microsoft Excel or Google Sheets, to create a digital debt payoff tracker. This allows for easy calculations and automatic updates of your remaining balance.

- Debt Payoff Apps:There are also debt payoff apps available that can help you track and update your debt payments. These apps often have additional features, such as payment reminders and progress charts, to keep you on track.

Tips for Staying Consistent with Updating the Tracker

Consistency is key when it comes to updating your debt payoff tracker. Here are some tips to help you stay on top of your tracking:

- Set Reminders:Schedule reminders on your phone or calendar to update your tracker regularly. This will help you establish a routine and ensure you don’t forget to record your payments.

- Make it a Habit:Incorporate updating your tracker into your weekly or monthly financial routine. By making it a regular habit, you’ll be more likely to stay consistent with tracking your debt payments.

- Keep it Accessible:Keep your debt payoff tracker printable or electronic spreadsheet easily accessible. This could be by keeping a printed copy in a visible location or saving the digital file in a folder on your desktop. The easier it is to access, the more likely you are to update it regularly.

- Celebrate Milestones:Celebrate your progress by acknowledging and rewarding yourself when you reach certain milestones, such as paying off a specific debt or reaching a certain percentage of overall debt reduction. This can help motivate you to continue updating your tracker and staying consistent with your debt payments.

Monitoring Progress and Celebrating Milestones

Monitoring your progress and celebrating milestones are essential aspects of debt payoff. They not only help you stay motivated but also provide a sense of accomplishment as you work towards becoming debt-free.

Strategies for Tracking Progress and Setting Milestones

Tracking your progress is crucial to stay on top of your debt repayment journey. Here are some effective strategies for tracking progress and setting milestones:

- Create a visual tracker: Use a debt payoff tracker printable or spreadsheet to visually represent your progress. This will give you a clear picture of how far you’ve come and how much you have left to pay off.

- Set specific goals: Break down your debt into smaller, manageable goals. For example, aim to pay off a certain percentage of your total debt within a specific time frame. This will help you stay focused and motivated.

- Track your payments: Keep a record of all your debt payments, including the date, amount, and creditor. This will not only help you stay organized but also allow you to track your progress over time.

- Regularly update your tracker: Make it a habit to update your debt payoff tracker regularly. This will help you stay accountable and aware of your progress.

- Review and adjust your milestones: As you make progress, review your milestones and adjust them accordingly. If you’re consistently surpassing your goals, it may be time to set more ambitious milestones. On the other hand, if you’re falling behind, consider adjusting your goals to make them more attainable.

Ideas for Celebrating Milestones and Staying Motivated

Celebrating milestones along your debt payoff journey is crucial for maintaining motivation. Here are some ideas for celebrating milestones and staying motivated:

- Treat yourself: When you achieve a significant milestone, treat yourself to something special. It could be a small indulgence, like a favorite dessert or a relaxing spa day. The key is to reward yourself in a way that aligns with your financial goals.

- Share your progress: Share your debt payoff journey with friends and family. Not only will this help you stay accountable, but it will also allow you to celebrate your milestones with your loved ones. They can offer support and encouragement along the way.

- Track non-financial milestones: Don’t just focus on the financial aspect of your debt payoff. Celebrate non-financial milestones as well, such as adopting frugal habits, increasing your savings, or learning new money management skills.

- Visualize your debt-free future: Create a vision board or visualization exercise that depicts your debt-free future. This will serve as a constant reminder of why you’re working hard to pay off your debt and can help you stay motivated during challenging times.

- Join a community: Connect with like-minded individuals who are also on a debt payoff journey. Join online forums, Facebook groups, or local meetups to share experiences, gain inspiration, and celebrate milestones together.

Additional Tools and Resources for Debt Payoff

While a debt payoff tracker printable is a valuable tool for managing and tracking your debt, there are other resources that can support your debt payoff journey. These tools can provide additional guidance, insight, and assistance as you work towards becoming debt-free.

Budgeting Apps

Budgeting apps are a convenient and effective way to manage your finances and stay on top of your debt repayment goals. These apps allow you to track your income, expenses, and debt payments all in one place. Some popular budgeting apps include:

- Mint: Mint is a free budgeting app that helps you create a personalized budget, track your spending, and set savings goals. It also provides insights into your financial habits and offers tips for saving money.

- EveryDollar: EveryDollar is a zero-based budgeting app developed by Dave Ramsey. It allows you to create a monthly budget, track your expenses, and monitor your progress towards debt payoff.

- You Need a Budget (YNAB): YNAB is a budgeting app that focuses on helping you break the paycheck-to-paycheck cycle and gain control over your finances. It offers tools for budgeting, goal setting, and debt reduction.

Debt Calculators

Debt calculators are useful tools for estimating the time it will take to pay off your debts and the total interest you will pay. These calculators can help you create a realistic repayment plan and understand the impact of different payment strategies.

Some popular debt calculators include:

- Bankrate Debt Payoff Calculator: This calculator allows you to input your debt details and calculate how long it will take to pay off your debts based on different payment amounts.

- Credit Karma Debt Repayment Calculator: Credit Karma offers a debt repayment calculator that helps you estimate your payoff timeline and interest savings by adjusting your monthly payment amount.

- Debt Snowball Calculator: The debt snowball method is a popular strategy for paying off debts. A debt snowball calculator can help you visualize and plan your debt payoff journey using this method.

Financial Blogs

Financial blogs are a valuable source of information, tips, and inspiration for those on a debt payoff journey. They often provide practical advice, success stories, and strategies for managing debt. Some popular financial blogs to explore include:

- The Penny Hoarder: The Penny Hoarder offers a wide range of articles on personal finance, including debt management, budgeting, and side hustles to increase income.

- Get Rich Slowly: Get Rich Slowly is a personal finance blog that covers various topics, including debt payoff, investing, and frugal living.

- Mr. Money Mustache: Mr. Money Mustache focuses on financial independence and early retirement. The blog offers insights into debt reduction, saving strategies, and achieving financial freedom.

By utilizing these additional tools and resources in conjunction with a debt payoff tracker printable, you can enhance your debt payoff journey. Whether it’s budgeting apps to stay organized, debt calculators to create realistic repayment plans, or financial blogs for guidance and motivation, these resources can provide valuable support as you work towards achieving financial freedom.

Tips for Staying Motivated and Focused on Debt Payoff: Debt Payoff Tracker Printable

Paying off debt can be a challenging and lengthy process, but staying motivated and focused is crucial to achieving your financial goals. Here are some tips to help you stay on track and motivated throughout your debt payoff journey.

1. Set Realistic Goals

Before starting your debt payoff journey, it’s important to set realistic goals. Break down your debt into smaller, manageable chunks and set specific targets for paying off each debt. This will give you a sense of progress and accomplishment as you achieve these smaller goals along the way.

2. Create a Reward System

Rewarding yourself along the way can help keep you motivated. Set up a reward system where you treat yourself to something small whenever you reach a milestone in your debt payoff journey. It could be something as simple as a movie night or a special treat.

Celebrating your progress will help you stay motivated and focused on your ultimate goal.

3. Track Your Progress

Keeping track of your progress is essential for staying motivated. Use your debt payoff tracker printable to update your progress regularly. Seeing the numbers go down can provide a sense of accomplishment and encourage you to keep going. Consider updating your tracker weekly or monthly to monitor your progress effectively.

4. Find an Accountability Partner

Having someone to hold you accountable can greatly help in staying motivated and focused on your debt payoff journey. Share your goals and progress with a trusted friend, family member, or financial advisor. They can provide support, encouragement, and help keep you on track when you feel discouraged.

5. Stay Positive and Focus on the End Goal

Debt payoff can be challenging, but it’s important to stay positive and focus on the end goal. Remind yourself of the financial freedom and peace of mind you will gain once you are debt-free. Surround yourself with positive affirmations and motivational quotes to keep your spirits high during challenging times.

6. Learn From Success Stories

Reading success stories of individuals who have successfully paid off their debts can be incredibly inspiring. Learn from their strategies, experiences, and challenges they faced along the way. Hearing about others’ achievements can reinforce your belief in your own ability to overcome obstacles and succeed in your debt payoff journey.

7. Seek Professional Help if Needed

If you find yourself struggling to stay motivated or facing significant challenges in your debt payoff journey, don’t hesitate to seek professional help. Financial advisors or credit counselors can provide guidance, support, and personalized advice to help you overcome obstacles and stay focused on your goals.Remember,

staying motivated and focused on your debt payoff journey is a marathon, not a sprint. Celebrate your milestones, learn from setbacks, and keep your eye on the prize of financial freedom. You have the power to take control of your finances and achieve a debt-free life.